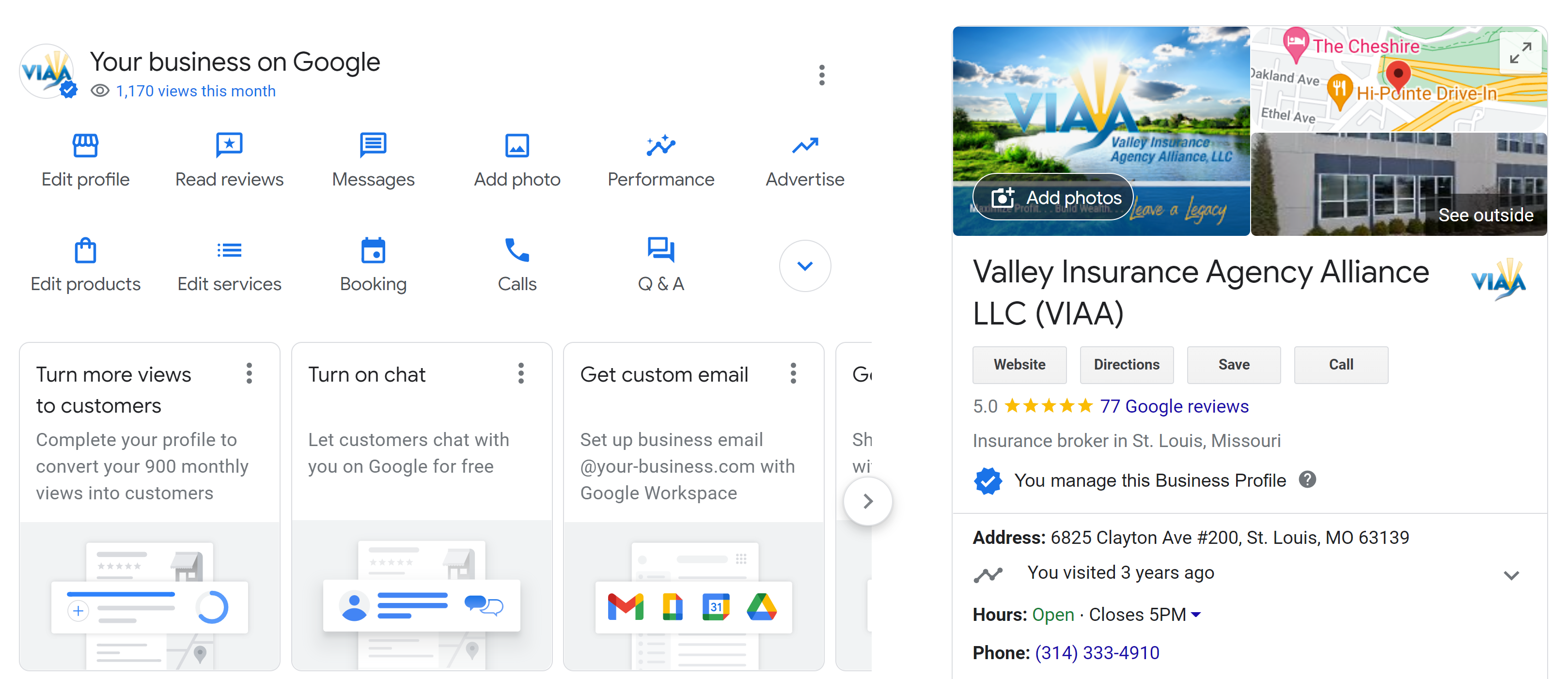

As you may remember, section 3A on the workers’ compensation policy lists the primary states the employer will be working in at the time the policy begins. Section 3C on the work comp policy will list all other states the employer may begin work in after the policy is effective. Section 3C “Other States” serves as a catch all or safety net. Section 3C allows the policy benefits to comply with the statutory benefits required by the state where an employee is injured, but in which the insured does not currently have or plan to have ongoing operations during the policy period.

How does Section 3C- Other States Insurance apply? According to the Workers Compensation and Employers Liability Insurance Policy, the following apply:

- The other states’ insurance applies only if one or more states are shown in Item 3C of the information page

- This is very important- If the state is not listed in 3A or 3C there may be a coverage gap and benefits could be negated or lessened

- If you (the insured/employer) begin work in any one of those states (one listed in Item 3C) after the effective date of this policy and are not insured or are not self-insured for such work, all provisions of the policy will apply as though that state were listed in item 3A of the Information Page

- The insured has 30 days to notify the carrier that they have begun work in a 3C state.

- We (the carrier) will reimburse you for the benefits required by the workers’ compensation law of the state if we are not permitted to pay the benefits directly to the persons entitled to them (provided the state was listed in 3 as a primary state, or 3C and is incidental in nature)

- If you have work on the effective date of this policy in any state not listed in item 3A of the Information Page, coverage will not be afforded for that state unless we are notified within 30 days.

- If an injury occurs in an unlisted, but should be 3A state, all benefits required of the state will be paid strictly by the employer

- Item 3C only covers incidental exposures in other sates

- When an employer starts to have employees in a state on a regular basis, the states need to be included in those listed on item 3A

Ideally, section 3C would include the following wording “All states and territories other than states listed in 3A, and monopolistic states”. This is not always possible or acceptable from the carrier’s point of view.

If the above wording is not allowed in Section 3C, then the following states should be named:

- All states bordering your primary state

- Any state to which employees travel to attend classes, conventions or other meetings on a regular basis

- Any state which should be listed as a 3A state, but the carrier is not allowing it

- It is very important to get it in writing from the carrier that they have denied 3A status and make sure the state is listed on section 3C when the policy arrives

If a worker is injured in a different state, they may choose where to file a claim. They would choose the state with the best benefits. That is why it is important to have the correct states listed in item 3A and 3C.

Items 3A and 3C- such small boxes on the Acord 130 that are often overlooked, but can have significant coverage impact if not completed correctly.