At VIAA, we strive to help aspiring independent agents make the move to an independent agency as seamless as possible. I often call on captive agents to discuss the opportunity and ownership afforded to them in the independent agency space. The question I get the most is, “I don’t even know how to do that! How do I even start?” This is a great question, with a multi-faceted answer that I can break down into five, simple steps. Every week, we will be releasing a blog that delves a bit more deeply into one steps of the process outlined below.

1. Register Your Agency Name

The first is the most straightforward – figure out what you want to name your agency and get it registered with your state. This part is simple, and you will not need anyone’s help getting it done. The remaining steps are where things get a bit more fun.

2. Get Carrier Representation

The beauty of the independent agency structure is the ability to represent a variety of carriers with diverse underwriting guidelines. This means you will be able to write all the types of risks you want, as well as identify how you are going to pursue those desirable risks. This is a huge part of crafting your agency’s business plan, which VIAA has the knowledge and expertise to help you with!

Beyond that, VIAA can help you vet and gain access to a wide net of carriers. As a network of over 130 local agencies, we can get you access to carriers you otherwise would not have access to. Additionally, as VIAA is a member of SIAA, of which there are over 5,400 agencies nationally.

3. Vet Technologies

Having the right technology can make or break your agency! From management to automation to HR – the world of insurance technology can feel overwhelming. Fortunately, VIAA has the manpower and experience to vet both new and old technology. This way, we can recommend the best technologies for your unique needs.

4. Implement Processes and Procedures

Errors and Omissions (E&O for short) are a scary prospect for agents new and old alike. However, our team at VIAA has the knowledge and tools to provide your agency with solid processes and procedures to protect you and your agency. Beyond that, we have the know-how to implement these processes as you are starting out your agency.

5. Start Selling!

This is hands down one of the most important parts of starting a new agency – you need to sell, sell, sell! Our sales staff have decades of experience selling personal, commercial, and life insurance. We are eager to pass down our knowledge and help your agency thrive. We know how to find leads and close sales – when you join the VIAA family, we will pass down all our best practices, tips, and tricks to you.

Are you ready to get started?

As you can see, the basics of starting your own, independent agency are less intimidating than you would think. If you want to start this conversation, you can reach out to me at 314-333-4932 or 618-960-5839. Additionally, you can shoot me an email at clintonm@viaa4u.com. I’d love to discuss the independent agency system and how it can benefit you.

If you want more information, keep an eye out in the coming weeks. I’ll be releasing a blog that dives into each of these five points a bit more in-depth. I’m excited for you to join us on the journey of starting your own independent agency!

About Us

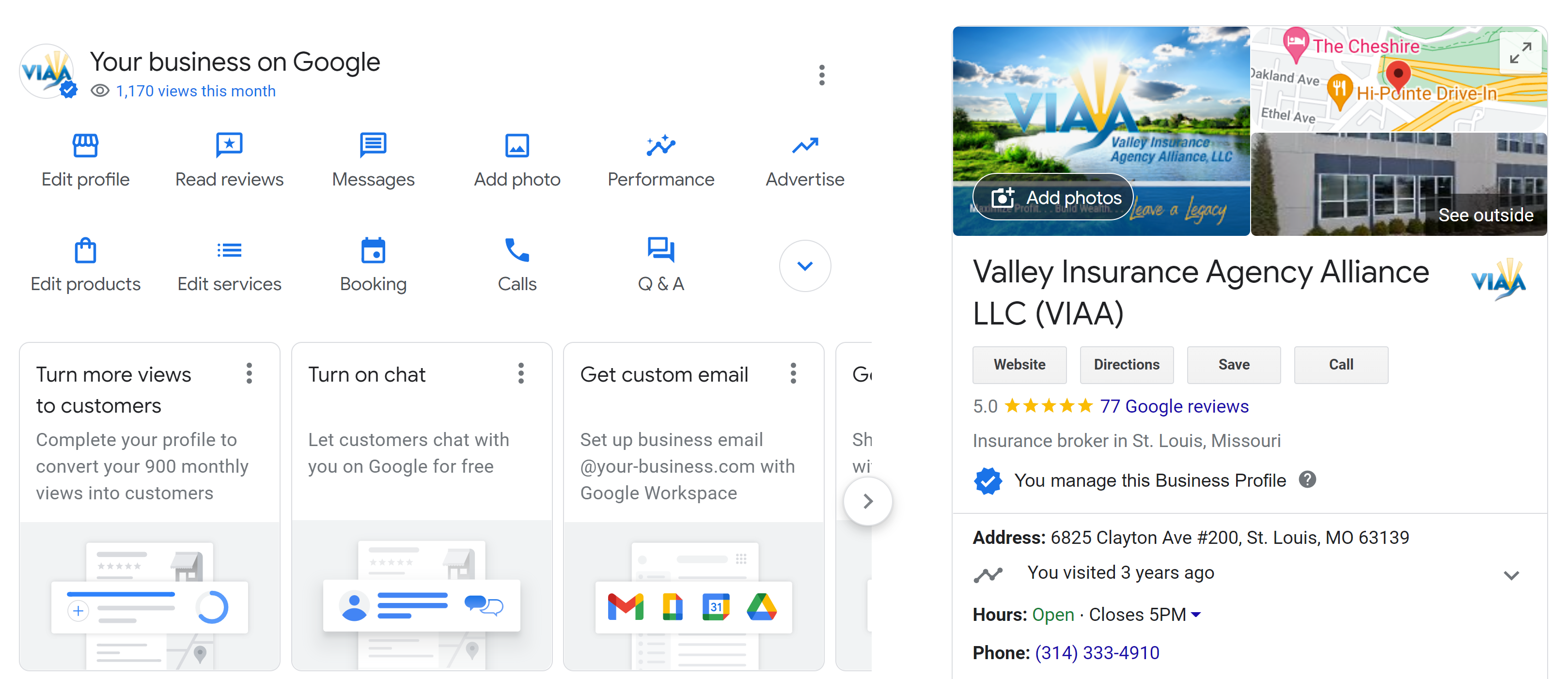

Valley Insurance Agency Alliance (VIAA), a cohesive family of more than 130 independent insurance agencies in Missouri and Illinois. Founded in 2006, VIAA generates more than $250 million in written premium and is the regional founding member for the Strategic Insurance Agency Alliance (SIAA), a more than $9 billion national alliance. Valley Insurance Agency Alliance is located at 6825 Clayton Ave. in St. Louis, MO. For more information about the alliance, call (314) 333-4910 or visit http://www.viaa4u.com.