Successful commercial agents focus on one primary mission, and that is creating and growing their commercial insurance book of business, but how do they do it?

Even though the insurance industry is known for its traditions, whether it’s marketing or how they sell policies, to customer engagement, the industry as a whole has been reluctant or slow to adapt to technological. Unfortunately, what has worked in the past is not enough to reach new customers anymore and those stuck in the past are missing out on ways to grow and expand their businesses.

Here are five proven ways that an insurance agent can grow their commercial insurance book of business.

1. Specialize in a target market, or niche.

Successful agents and agencies narrow their focus to a target market or niche. Agents who specialize in specific needs become experts that business owners seek out.

Choose something you know well instead of casting a wide net to sell commercial insurance to every business. For example, suppose you worked in restaurants for years before going into insurance and know the industry’s protection needs. Now, imagine you’re presenting a quote to the owner of a restaurant. If you could explain your knowledgeable background in the restaurant industry coupled with your insurance expertise you have now, you would be a strong candidate if not win the account every time.

Developing a niche has multiple benefits whether targeting small commercial or attempting to go upstream. On the whole, specializing in a niche market helps your business be more efficient and have higher conversion ratios. In the small commercial space, it’s critical to be efficient and have a high hit ratio to maintain profitability. Typically, you want to focus on classes of business in which one or more of your preferred carriers have at least a 30% or higher hit ratio.

Finding a niche can be as simple as identifying underserved or less competitive businesses. Traditional marketing would not effectively or efficiently help these customers find you.

Since success in small commercial requires being highly efficient, it is important to utilize technology, focus on classes of business that will allow you to have a high close ratio and focus generally on one or several niches so that you don’t have to reinvent the wheel/figure out your process and solution with each new opportunity.

Marketing to niche groups

Narrowing your focus to fewer prospects makes managing your business, providing service, and managing customer expectations easier. Insurance agents can’t be all things to all people.

Having industry specific landing pages, making targeted social media posts and participating in leadership positions in trade associations focusing on your niche are all ways to elevate your standing in your niche market.

For example, agencies trying to cast a wide net would probably not go to a restaurant trade show. But a commercial insurance agency setting up a booth there informs everyone that their brand has experience solving restaurant owners’ unique insurance difficulties.

Niche insurance products

Your niche market does not have to be limited to industry. You can also specialize in a type of commercial insurance like liability insurance, workers’ compensation insurance, errors and omission insurance, or commercial property insurance.

Or perhaps you’re the only commercial insurance agency that handles insuring the business holistically by setting up buy-sell agreements and key man life insurance programs.

2. Precisely define your best fit client

It’s hard to grow your commercial insurance book of business with the wrong clients. Agents and agencies should define the ideal client that makes them feel emotionally, intellectually, and financially rewarded.

Fortunately, insurance professionals can choose with whom they do business. For example, suppose you love working with construction contractors, but retail is too unpredictable for you. You can choose to only work with builders and stay out of other businesses that don’t work for your mission.

But if you can be very specific about which business objectives align with yours, you’re better prepared to solve them.

In turn, clients who better suit your business’s mission are more likely to recommend you to others.

3. Develop your value proposition

Another way to grow your commercial insurance agency is by crafting an effective value proposition. They tell customers what to expect from your business and why they should do business with you instead of a competitor down the street. Value propositions are critically important, but they can also be a tough nut to crack.

First, it must demonstrate why you are the best choice for the customer, not your competitors. This message should be simple and easily explained.

Second, keep your value proposition focused on the customer and prospect, not you.

Why does someone choose Uber over a taxi? The taxi is already there if you’re at an airport. Uber’s message is that they provide a simplified and more convenient way to find a driver who already knows where you want to go. And then you get out, and the app charges you.

In commercial insurance, it’s not enough to say, “we have the best insurance.” You don’t. Thousands of other agents sell the same thing at the same price.

However, your business offers your customers a different experience and service than other agencies. Your business will succeed when customers quickly and clearly understand how your agency saves them time, makes insurance more convenient, or provides more personalized service.

4. Develop a center of influence strategy

Although it’s a traditional strategy, don’t overlook the importance of building a center of influence network to build your commercial insurance book of business. Centers of influence are people/organizations who can open new market access through referrals and word-of-mouth testimonials.

Natural allies of insurance agencies are accountants, financial advisors, attorneys, real estate agents, and lenders because they engage a similar customer base. Center of influence relationships will help reinforce your insurance expertise within your niche while introducing you to new and desired prospects and contacts.

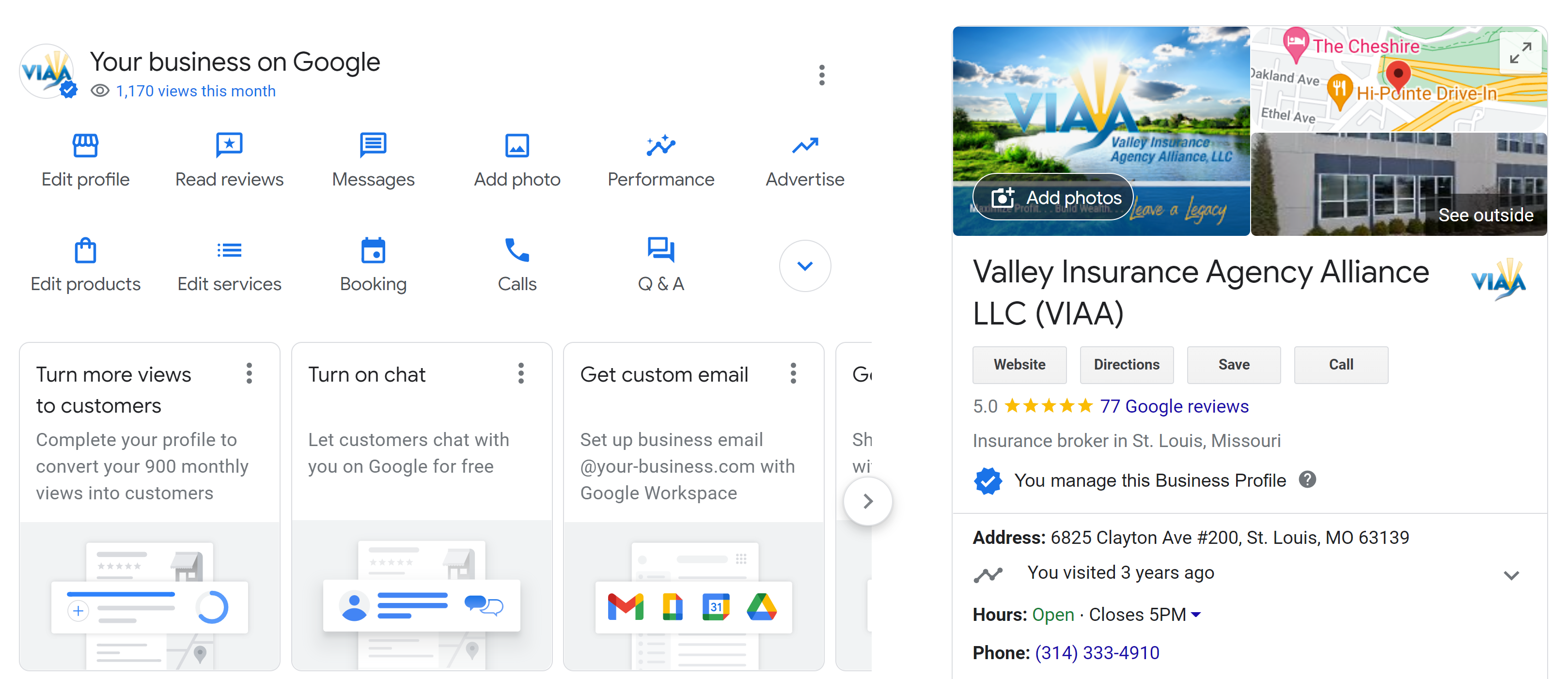

5. Show an active and current presence in online media outlets

To build your commercial book of business, You can do a lot to keep your name well-regarded by your ideal prospects by keeping an active and engaging social media presence.

Providing high-value content without a constant sales pitch is vital to create an engaging social media presence. In addition, business owners take notice of content that educates and gives them food for thought.

Businesses create content in the form of short written posts with appropriate graphics, short-form video, long-form video, and long-form written content like blog articles.

Your online posts can also provide a call to action inviting the prospect to contact you or get something valuable, like a free guide or worksheet in exchange for their contact information.

Over time, your social media outlets become your brand and give your prospects and customers a sense of what your business is about.

Finally, your business can nurture its relationship with customers and prospects by engaging them via email with valuable information such as a recent video or blog post your company created. It reminds prospects that may not have engaged with yet, that you’re a viable option and ready to help.

The main concept in all this is to have a plan and to execute it! You must be consistent in your process and approach. You must put forth the effort in order to get the results you need. Building your book starts with building up your targeted prospects and your effort to engage those contacts on a regular basis, building rapport and value. This process takes time, and you must perform and fire on all cylinders in order to convert these leads into sales.

Being a part of an alliance that can provide support, training and resources can help escalate your agency’s growth and provide additional revenue and commissions. Using the right technology to accomplish your goals along with these strategies can help your agency get to where you want to be, much quicker than just doing business as usual. Embrace change and technology, allow your agency to grow and be competitive in this new and ever-changing market.