As you’ve seen from my first article in this series (How to start and Independent Agency in 5 steps) and my second (How to register your agency name), I’m passionate about helping captive agents move into the independent agent marketplace. I firmly believe the opportunities afforded in this space are numerous and set us up to best help our clients. One of the biggest roadblocks for potential independent agents, is how challenging the process of becoming independent seems.

Fortunately, this process can be broken into a five, easily digestible chunks: name your agency, get carrier representation, vet technologies, implement processes and procedures, and start selling! As we’ve already outlined how to pick the perfect name for your agency, this week we will be focusing on getting the carrier representation you need to best serve your clients.

From Business Plan to Representation

The beauty of the independent agency structure is the ability to represent a variety of carriers, who can write all the different types of risks you’ll come across in your day-to-day operations. In order to get access to these carriers, you will first need a business plan that lays out what type of clients you want to insure. In that plan, you must include how you will attract those types of prospects, and then the number of those prospect you need to attract every year to reach your goal.

Once you have your business plan written, the real work begins. After all, how do you sell this plan to the carriers? To put it simply – this part is challenging and requires a certain level of insurance industry expertise. You need to “know” many things, including:

- How do you find a carrier that writes the business you want to attract?

- Who do you contact to start writing business with this carrier?

- How do you know if this carrier is legitimate?

- How can you negotiate good and fair contract terms?

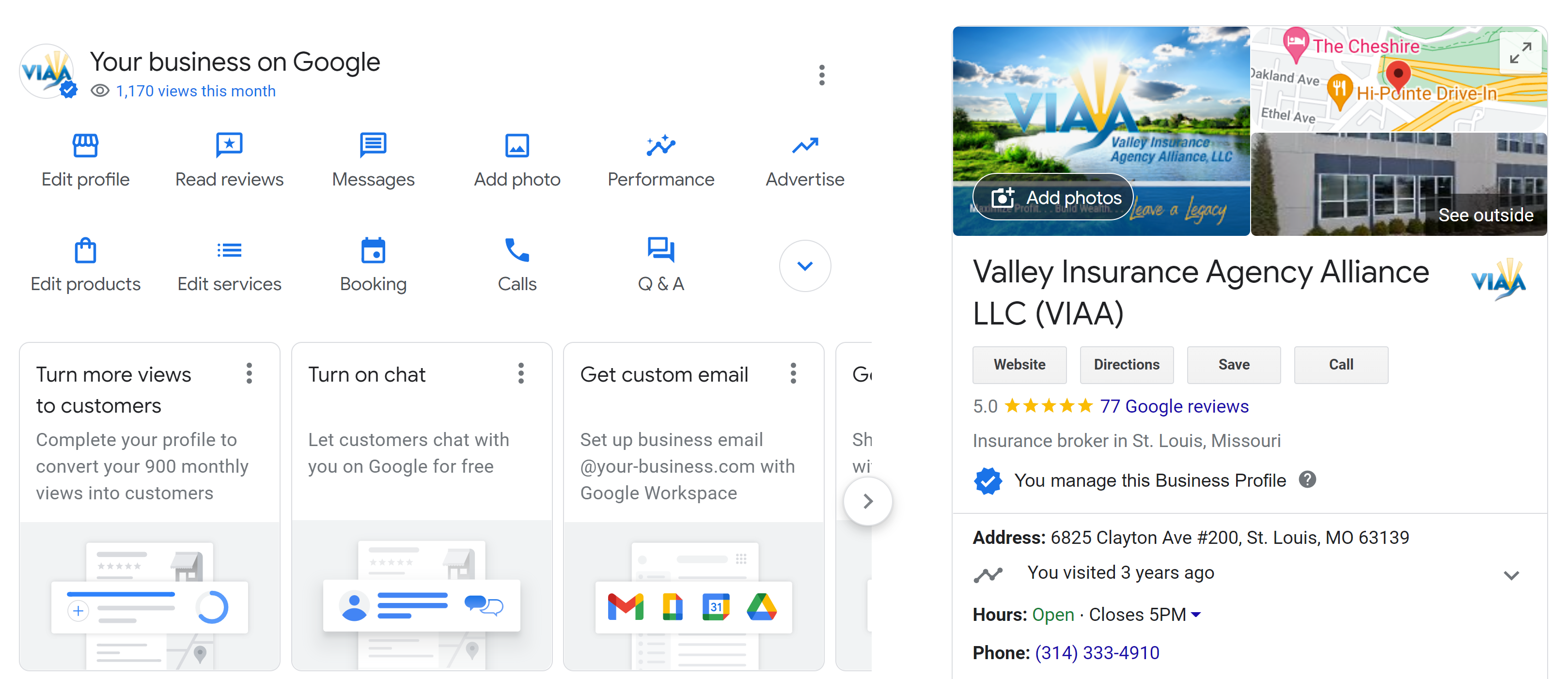

Fortunately, when you join the VIAA family, we are able to use our 15+ years of expertise in making sure you find the perfect fit for your agency. As we have long-standing relationships with many of the major carriers in the independent agency scene, we are able to create bridges and help your agency as you begin to form your own relationships.

Many new agencies run into a major dilemma, when they find that many larger, reputable carriers have barriers to entry. These carriers look for well-established books of business to get appointment contracts. However, when you start from scratch, you typically don’t have that. With a lack of business on the books, you are likely to be denied. However, with the support of a major player in the insurance scene, like VIAA, we can help negotiate terms and get you access to some of these carriers.

VIAA Can Help

At VIAA, we help our agencies find the carriers that are a right fit for their business model. When you join, we are able to help you put together a business plan that identifies what clients to attract, how to attract those clients, and how many of those clients you need to attract to succeed. From there, we can create production goals to fuel your growth.