Consumer Reports

Copyright © 2007-2013 Consumers Union of U.S.

You spend a lot of money on insurance to protect your home, so don’t get caught short because you misunderstand how your policy works.

The big mistake to avoid here is failing to supplement your basic coverage. Although the standard homeowners insurance policy covers damage caused by certain major threats—fire, hail, wind, lightning, falling trees, tornadoes, cars, and vandals—it doesn’t cover some others. Those include earthquakes, hurricanes in many locations, and flooding, whether caused by bursting levees, overflowing rivers, or a spring thaw. So you must buy extra coverage for those perils.

Standard coverage

Standard policies, called HO2 or HO3 policies, cover damage to your home and other structures on your property, such as a garage, barn, shed, and fencing. Insure the “replacement value” of your home, which is often higher than its tax-assessment value and market price. You should also opt for two extra-cost riders: the “extended coverage” rider, which adds up to 30 percent to replacement value to cover higher costs for materials and labor that often follow a natural disaster, and the “ordinance” or “law endorsement” rider, which pays the higher cost of making repairs that conform to current building codes.

Standard policies also cover your furniture, electronics, clothing, and other belongings as well as your liability for people injured in your home or for damage that you, your children, and your pets cause to others. Liability coverage typically starts at $100,000; you should buy at least $300,000. These extras will raise your premiums, of course, so keep that in check by taking a $500 or $1,000 deductible, and be sure to keep that amount in savings in the event of a loss.

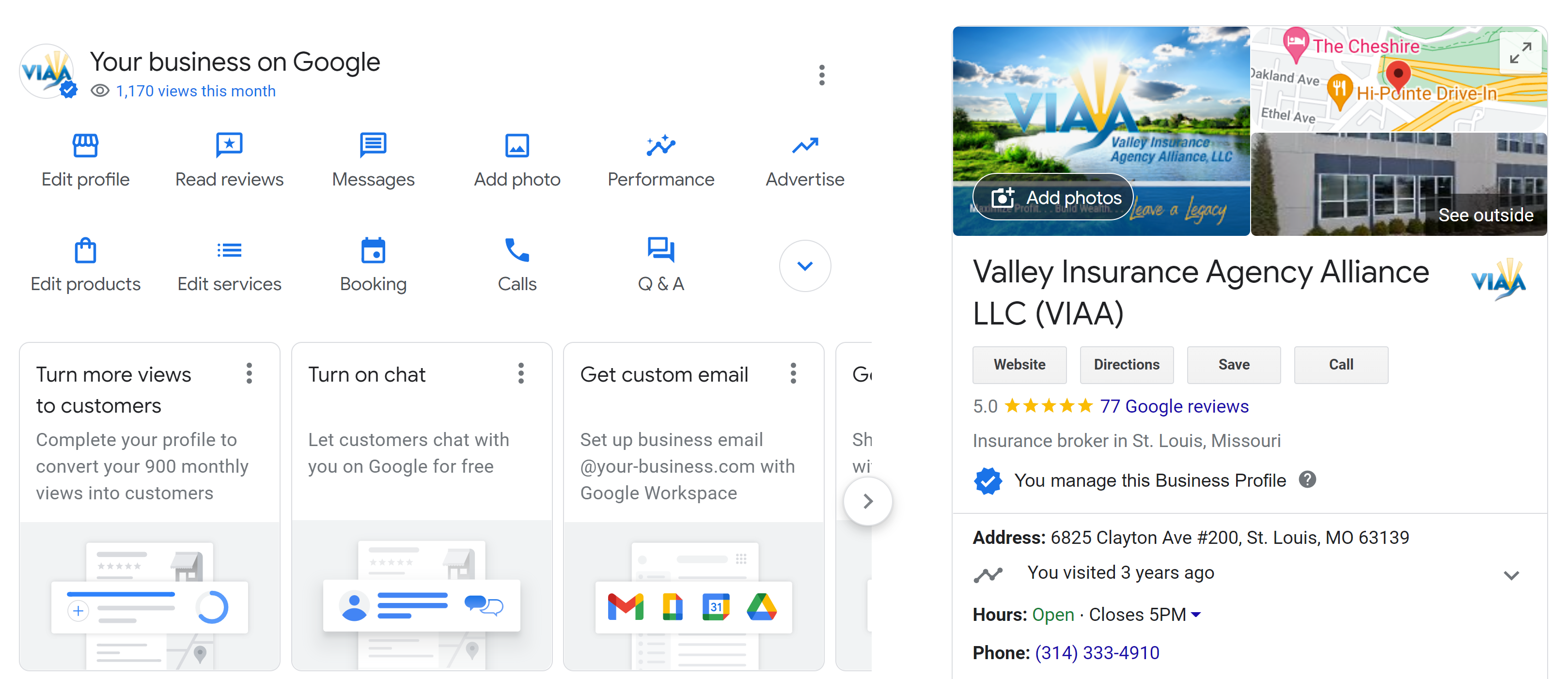

Do you want to upgrade your insurance coverage to make sure it does what you expect. Give us a call today!

Flood

A standard policy doesn’t cover flood damage, which can be quite expensive. Just an inch of water can cause over $20,000 in damage, mostly to carpeting and finished flooring, and for cleanup. Private insurers usually don’t cover flooding at all, but you can buy federally sponsored protection from your agent through the National Flood Insurance Program. (Go to floodsmart.gov for information). If you live in a high-risk area, your mortgage lender probably requires you to have flood insurance. But even if your risk is moderate to low, you should consider it because premiums are commensurately lower than standard- or high-risk coverage.

Sewer backups

When the toilet backs up or the sump pump fails, neither flood insurance nor the standard homeowners policy will cover it. Buy separate coverage or an endorsement for $40 to $50 a year.

Hurricane/wind

Your basic policy might provide coverage for damage caused by hurricanes, but states along the Atlantic and Gulf coasts, from Texas to Maine, as well as Hawaii and the District of Columbia, allow insurers to charge higher hurricane deductibles. They’re triggered by officially designated storms under a variety of circumstances specified in your contract, and they supersede your standard deductible.

Hurricane deductibles typically range from 1 to 5 percent of the home’s insured value. So for a house insured for $300,000, you would have to pay the first $3,000 to $15,000 out-of-pocket before your insurance company pays a dime.

Do you need to update your homeowners insurance? Call us today!

Insurers have abandoned some hurricane-prone areas, leaving homeowners in those places to depend on separate hurricane policies from state-run insurance pools, such as the Texas Windstorm Insurance Association, Florida’s Citizens Property Insurance, and the North Carolina Joint Underwriting Association. That coverage is well worth considering.

Earthquake

The 5.8 magnitude earthquake that rocked Virginia and a swath of the East Coast in August 2011 was a wake-up call for those who thought California had a monopoly on seismic activity. Standard homeowners policies exclude earthquakes, but most insurers sell earthquake coverage as an endorsement or separate policy, and California residents can buy it from insurers in the state-managed California Earthquake Authority. Expect higher earthquake deductibles in more active areas.

Valuables

If you own expensive antique furniture, furs, jewelry, silverware, artwork, or other valuables, such as a coin collection or baseball memorabilia, you should buy a special endorsement or “floater” to cover their full value in the event they’re lost, stolen, or destroyed.

Household workers

Casual and occasional workers—a babysitter or a neighborhood kid mowing your lawn—are typically covered by the standard policy for injuries sustained on your premises. But for permanent full- or part-time domestic employees, also consider having workers compensation insurance, which covers them if they’re injured on the job. Check if other workers employed by small businesses—for example, plumbers, home health aides, or gardeners—are insured by their companies.

Did you know that if we had your auto and homeowners insurance you may qualify for an additional discount? Call us today to learn how!