- Did you know that in Missouri, if you have 5 employees you are required by the state to have Workers Comp Insurance? Unless you are a contractor, then the state requires that you have Work Comp insurance if you only have one employee.

- In Illinois, if you have one employee, you are required by the state to have workers comp insurance

- In Missouri, currently the minimum payroll for owners, officers or llc members is $39,500 and in IL the minimum payroll is $52,300.

- Workers Comp insurance is designed to be a no fault program.

- Most states have their own Workers Compensation Law which is set up in their state statues. Workers Compensation laws are usually governed by the Department of Labor in that state.

- The MO work comp law is state statue 287

- The limits shown on the workers comp policy are actually for Employers Liability Insurance, not work comp. Work comp payments are set up in each state statue.

- There are 4 states where you can only buy work comp insurance from their state carrier ( WY, ND, OH and WA)

- If required by law to purchase WC insurance, the employer must purchase WC insurance or certify with the state that they are self insuring ( they must show proof that they have money set aside to cover claims). If they just decide to “self insure” without certifying with the state they are breaking the law, and they are also removing the exclusive remedy solution – opening themselves up to civil suits. Also, the employer would still be fully responsible to cover the injured employee at the state required level of benefits( they can very quickly go out of business)

- Failure to purchase WC insurance when required by law is a criminal offense. In MO the first offense is a class “A” misdemeanor, punishable by up to one year in jail and a fine up to three times the annual premium the employer should have paid or up to $50,000, which ever is greater.

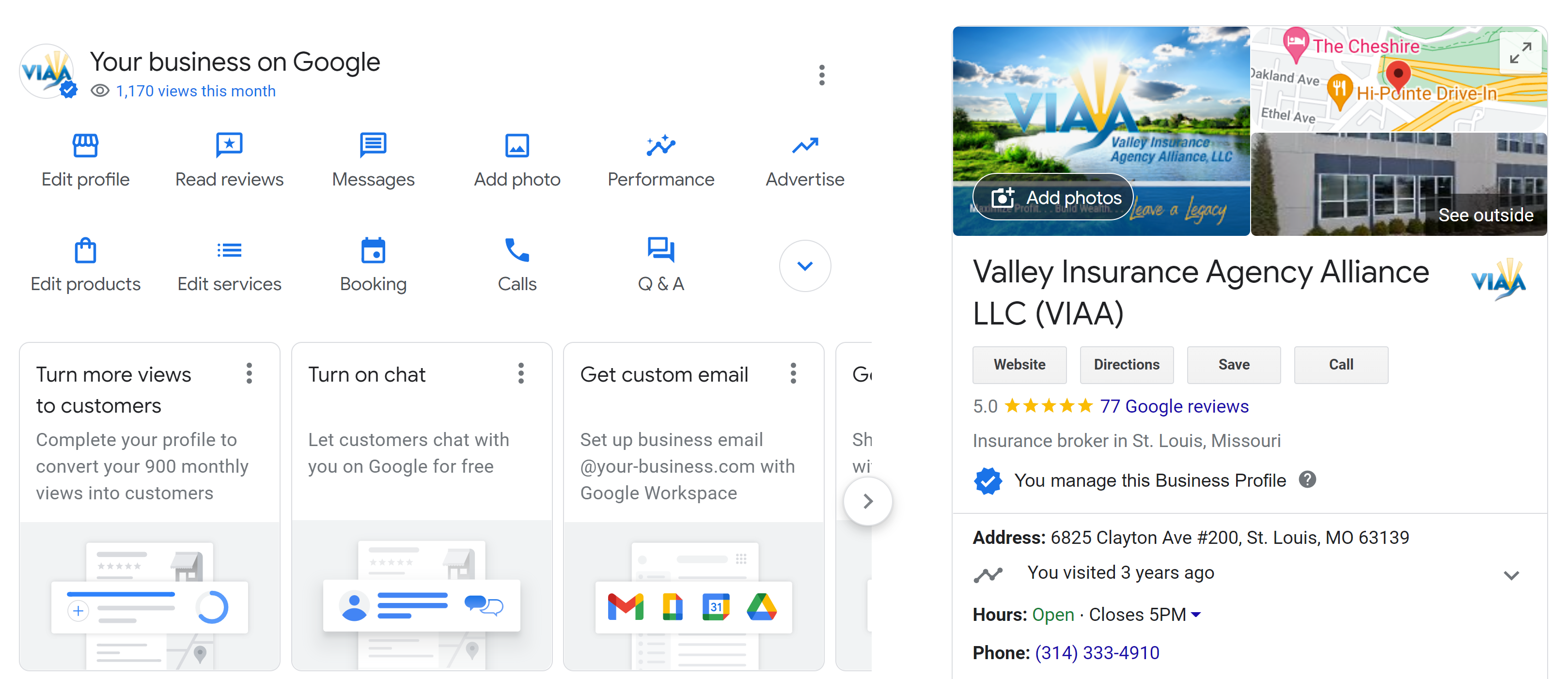

Why You Should Regularly Update Your Google Business Profile

A Google Business Profile for your Independent Insurance Agency is an often overlooked but crucial tool for any independent insurance agent. Considering over half of