Below are links to two articles that I think you need to take the time to read and then digest. I would be interested as to what you thoughts are. I have also posted this on the blog. Thought it might be a good topic for dialogue.

This link takes you to the McKinsey Report. It has created a lot of conversation on the carrier side and I guarantee this mindset is top of mind for your reps. Therefore it should be for you as well for no other reason than to understand why they may say or do certain things. For global forces discussed during our closed session, I do agree our industry will be forgoing substantial change over the next 5 years. In our opinion, the solutions offered need to be taken with a grain of salt as they do not understand our industry.

Now for the link to the Big I’s response to the McKinsey Report. Bear in mind the Big I exists on membership dues. The McKinsey prediction and resulting magnitude of constricted distribution would be a tough hit to their bottom line. Their outright dismissal should also be guarded.

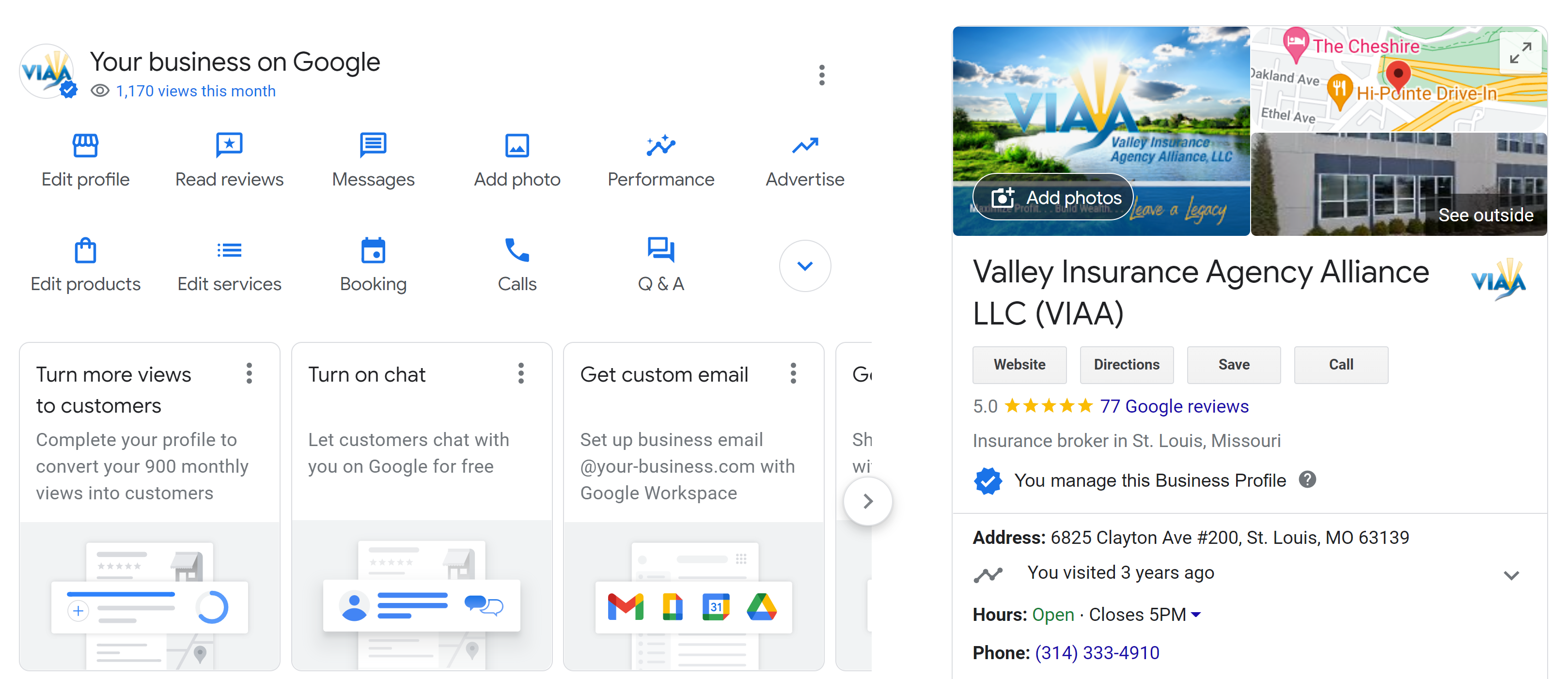

At this point the future is uncertain and I believe nobody’s crystal ball is all telling. What I do know is that the Independent Distribution channel has endured change and it will continue to endure change. Your decision to join VIAA/SIAA provides the necessary scale and leverage as well as spread of risk that most other agencies to not enjoy. Clean, steady, and BALANCED growth, I believe, is the winning equation. This is not only balance between home/auto but also personal/commercial. When looking at the numbers globally it is the balanced agency that is most healthy year over year. Personal lines swings from wildly profitable to negative as it is difficult to underwrite the weather. Commercial on the other hand tends to be profitable until you have a shock loss. While it is possible to realize both a shock loss and catastrophic weather event in the same year, it is one less star that must align before your bottom-line looks as dismal as the competing agencies McKinsey compares us. Partnering with experts for Life and Health product offerings is also a must. If you do not wrap up these lines your competition is in there building a relationship.

For those of you that do not currently pursue commercial, the first step is building a list of x-dates. You may consider a select group of “niches” where you become an expert. If you have experience in a particular industry, this niche would be a natural fit. If you are in need of direction, we have tools to help develop a Best Practices’ process. Please email Elizabeth or myslef if you would like to setup a conference call.

Yours Very Truly, Henry