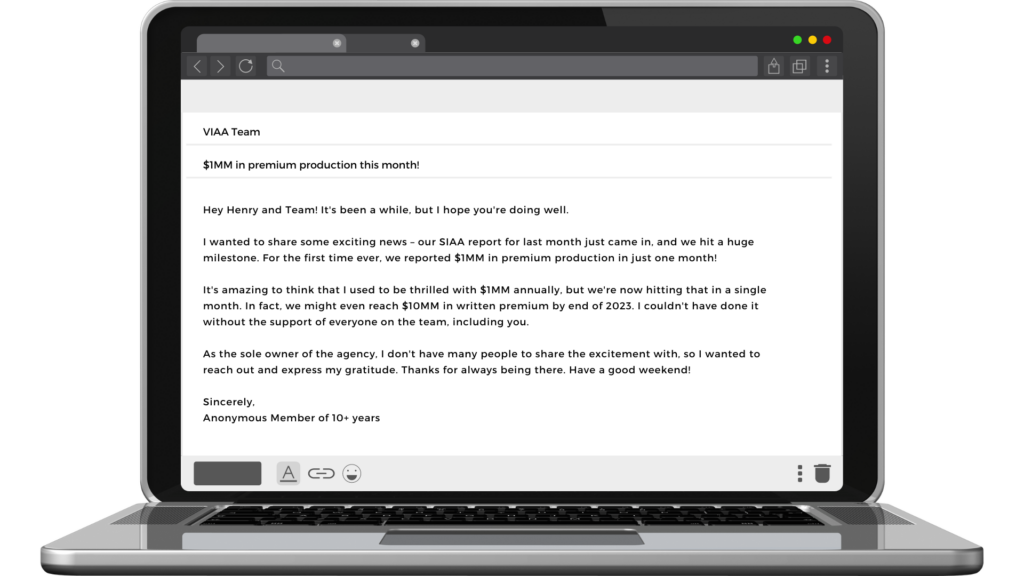

Recent email recieved

Video Testimonials

It starts with WHY

"They were able to help us get started and help us grow fast!

They had an answer to every single one of our questions."

-- Kristen, Member since 2011, ROI 2.33x

Asked how I was going to make a paycheck that year . . .

"Started looking at the inventory I had and what was left to go after... felt like I was limited on opportunites."

-- Nick, Member since 2012, ROI 1.2x

They helped us expand into 41 states . . .

"At the end of the day, I can make more money, I can provide better customer experience, and I have more tools and resources."

-- Matt & Suzie, Member since 2008, ROI 1.44x

Mark was skeptical . . .

"Henry Powers walked through my door with a yard stick and said he could make my life much better. Of course, I didn't believe that."

-- Mark, Member since 2008, ROI 6.07x

They help protect and enhance

our future . . .

"Valley has helped position me for the eventual sale of my agency and with that it would bring a premium to my family when they decide to sell it."

-- Jim, Member since 2015, ROI 5.14x

I passed my 5 year goal in 18 months . . .

"They gave us different markets, different ideas and different ways of doing things. They're always trying to think of what the future will bring and stay ahead of the curve."

-- Kevin, Member since 2014, ROI 0.92x

The core of the culture is family . . .

"Even though this is a business, they do truly care about the success of the agencies apart of the organization."

-- Matt Masiello, CEO of SIAA

We had never been offered profit sharing before . . .

"We met with a half a dozen or more companies and nothing stacked up with what Valley had to offer. With the VIAA model, it doesn't work for anyone unless we're growing and making money. "

-- John, Member since 2008, ROI 1.04x

I knew the captive I was with wasn't a sustainable business venture . . .

"Being a few years in now, I'm seeing far greater growth than I ever anticipated. Other Members said it was possible but I thought they were exaggerating. Nobody is exagerrating!"

-- Amber, Member since 2014, ROI 1.13x

We're able to quote 75-80% of the business that walks in . . .

"The first benefit Valley added was company access. The second was an environment to collaborate with other agents."

-- Jon, Member since 2007, ROI 2.06x

I was doing well but the income wasn't coming in . . .

"I walked away from a $500,000 book I had built over 4 years. I had to re-start with nothing and I wouldn't have been able to do that without them."

-- Gary, Member since 2007, ROI 2.18x

Valley gives us the clout that larger agencies have . . .

"I believe that Valley is loyal and loyalty is a very important characteristic to have in a business partner. "

-- Frank, Member since 2014, ROI 5.36x

As an Independent Agent you become more of a counselor . . .

"As a captive agent I felt limited. When I started to tell people they had to go somewhere else, I thought why am I doing this? "

-- Keith, Member since 2010, ROI 0.5x

None of the companies would

appoint me . . .

"Now I'm appointed with over 20 companies. "

-- Grady, Member since 2015, ROI 2.37x